“Luck is where the crossroads of opportunity and preparation meet.” Seneca, first-century Roman Philosopher

You have worked hard on building a business and deserve the fruits of your labor.

How do you know what to expect? The answer is in the valuation of your business.

Business valuation is a process of proven procedures used to estimate the value of an owner’s interest in a business. The valuation method is used to determine the price a seller would be willing to accept to sell the business to a prospective buyer based on the company’s current worth in the marketplace.

The value of the business depends on the assumptions underlying it. For example, the valuation is affected by the economic conditions at the time of sale (expansion versus recession) and how the business is sold. Is there a plan in place to sell the business or will the assets be sold at auction or in a “fire sale?”

There are four ways to measure the worth of an enterprise. They are the Asset, Income, Market, and Synthesis approaches.

Asset Valuation

The asset approach is based on the economic principle of “substitution.” What will it cost to create another business like the current one that can produce the same economic benefits for its owners in the future?

The value of the business is deemed to be the difference between its assets and liabilities. This is the owners’ equity in the business.

The process includes determining which assets and liabilities to include in the valuation, choosing an agreed upon standard for measuring their value and deciding what each asset and liability is worth. The excess of the assets over liabilities is the value of the business.

Income Valuation

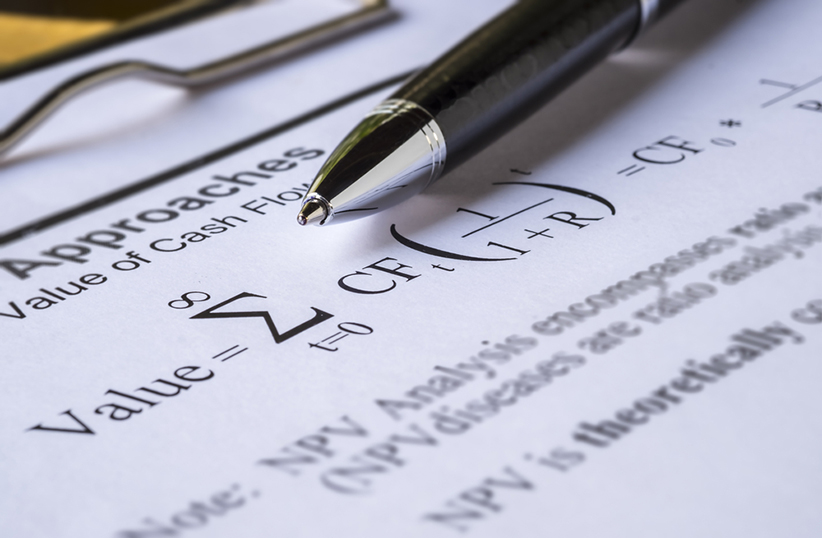

An income approach looks at the present value of receiving a future stream of income. It is based on the economic principles of “expectation” and “risk management.” When a business owner invests time, money and effort in a business, what economic benefit will accrue to the buyer of that business and when?

Since the benefit is to be received in the future over a specific period of time, there is both an expectation and a sense of risk borne by the buyer. This economic condition is represented in the calculation of the value of the business by “discounting” the right to receive a predetermined amount in the future by the probability of not receiving all of the money. The higher the risk of not receiving all of the earnings the higher will be the discount rate. The higher the discount rate the lower the value of the business because there is a larger probability that all the promised income will not be received within the specified time period.

Market Valuation

The market approach relies on the economic principle of “competition.” What are other businesses worth that are similar to the existing business?

The assumption is if you are a buyer looking for a particular type of business you will research what people are paying for similar businesses. Alternatively, if you are a seller of a specific type of business, you will investigate what owners are accepting for similar businesses.

The idea is that there will be a “price equilibrium” that a willing buyer will pay and seller will accept that determines the “fair market value” of the business. The buyer and seller’s data must support each of their price proposals based on their market research.

Business Value Synthesis

Combining the above methods is called the synthesis approach. It compares and contrasts the asset, income and market methods to form a single, integrated value for the business. This approach tends to yield a more agreeable value when the business has uneven income streams, high-risk conditions such as pending litigation, loss of intellectual property rights or there is a disagreement about which valuation method should be used.

How We Can Help You

Pacific Crest Group provides professional services that keep your business focused on your critical objectives. We provide strategic Accounting and Human Resource (HR) services created specifically to help you meet your goals. Through exemplary customer service, clearly defined policies and procedures as well as a forward looking perspective, we provide the outsourced solutions your business needs to grow. A PCG professional is happy to meet with you to discuss solutions for your unique requirements designed to maximize all of your business opportunities.