Be Your Company’s Revenue Hero

The greatest challenge of being an entrepreneur is being all things to all aspects of your business. While this might work in the short term, for the long term, it’s not sustainable. The true path to growth is setting aspirational yet achievable goals, none of which are possible without the right financial foundation and roadmap in front of you.

Perhaps this is you:

- You have a clear vision of where you’re headed next but you’re mired in the day-to-day operations of your company.

- You have the financial skills to keep things moving in the short term, but you don’t have the time or desire to think about a long-term strategy.

- You’re a creative visionary and simply just not a “money person.”

If you see yourself, or an aspect of yourself above, who’s looking out for your bottom line? And, where do you want your business to be in 18 months? 3 years? 10 years?

Do you know the answer?

Whether you want to grow your business or simply need to get your financial house in order, below we will unravel a few mysteries about the financial side of any business and help you determine what you need to get to that next level.

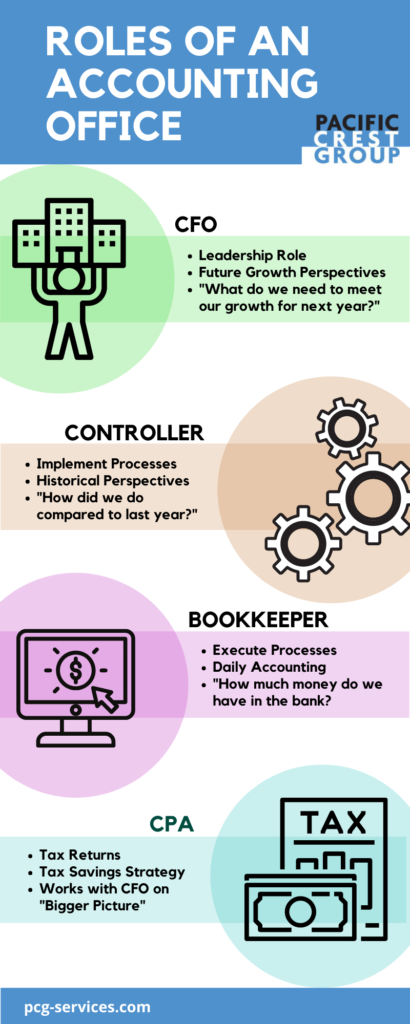

CFO

This is a leadership role that works closely with the CEO and other members of the leadership team. They have a deep understanding of the entire accounting process of a company and assist the CEO with future growth perspectives. They possess the psychological stamina and judgment to look into the future of where the finances need to be to best position the company to achieve its goals, even in an environment filled with unknowns and multiple variables. Typically, the CFO will help with business financing activities, business acquisitions, and establishing financial best practices such as reserve capital, retained earnings, etc. The CEO might ask the CFO “What do we need to have in cash reserves to be able to meet our growth for next year and what questions am I not asking that I should be asking?” In the best-case scenario, the CFO will have already told the CEO the answer to this question. Depending on the size and scope of your business, other associated titles performing similar functions are Financial Consultant, VP of Finance, Director of Finance.

Controller

This role is clearly defined to develop and implement processes and oversee the accuracy and efficiency of the accounting department. The principal role of the Controller is to ensure the data is accurate, timely and efficiently entered (“controlling”), as well as providing oversight to the entire accounting team. They like to define checklists, policies, and procedures and make recommendations on improving the software or workflow processes within the company. This role is excellent at looking at where the company has been from a historical perspective. A CEO might ask the Controller “How did we do compared to last year and what were our biggest costs centers?” Other associated titles performing similar functions are Accounting Manager, Staff Accountant, Accountant.

Bookkeeper

This individual (or individuals) thrives in executing the processes set forth by the Controller. They enjoy the clarity of their accounting responsibilities and following repetitive processes such as invoicing customers and paying bills. They prefer to have systems that are well defined and someone who will support them in their role and duties. They can often answer the CEO’s question, “How much money do I have in the bank?” Other associated titles include Accounts Payable Clerk, Accounts Receivable Clerk, Bookkeeper.

What about a CPA?

A CPA is typically in the business of preparing tax returns and advising on tax savings and strategy while a CFO is in the business of strategic financial positioning for the business goals. These two goals might not always line up, so the CFO and the CPA work closely together to balance the “bigger picture.”

If these functions are covered well, you have created a solid base and an important measurement tool for your entire company’s operation. If not, seeking help to get your accounting department in order is a heroic act for your business. Schedule your free financial checkup and outsourcing options with PCG.