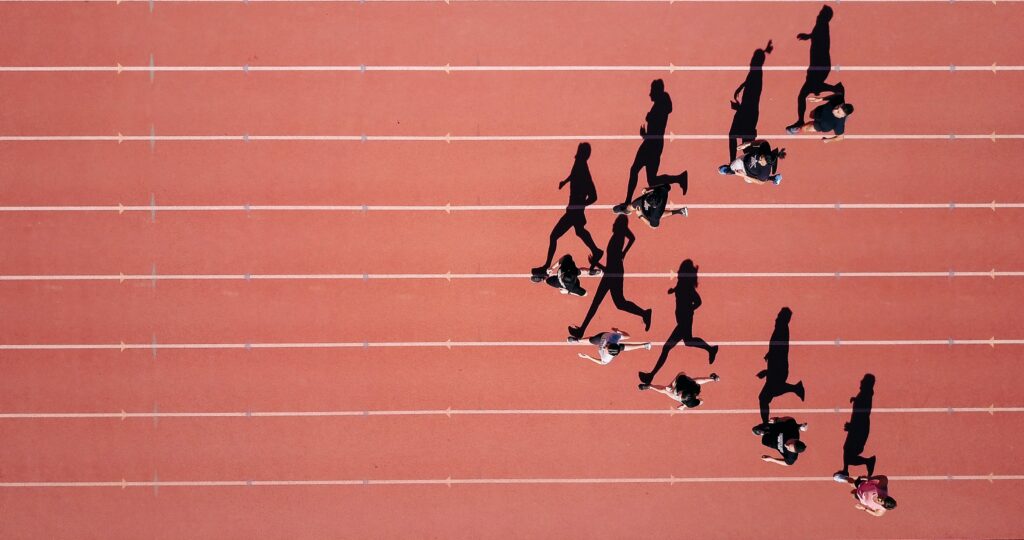

If you view the fiscal year like a marathon, this is the time of year that defines how hard you stumble across the finish line. What worked in 2019 is muddied by the changes of 2020, and somehow, we are accelerating towards the end of 2021. So how will you finish strong in this final foot race of the year and set 2022 up for success? Follow these tried-and-true tips for a clean close to Q4, and you’ll hit a new stride in 2022.

Your processes are only as good as the innovation behind them, so as you go through these steps, examine each one for areas of improvement. Ideally, most of these steps should happen monthly, but a final review on an annual basis is key to closing strong.

Get In Shape

Reconcile bank accounts – Make sure the numbers you have in your accounting software program match statement balances. Review and resolve errors, double entries, or uncleared checks.

Wrap up your accounts receivables – This may sound obvious, but every business has at least one receivable waiting to be closed. Follow up on any invoices for products sold, tasks completed, or services rendered in the current year.

Record accounts payables – Double-check all accounts to confirm that you have entered all invoices from your suppliers or vendors and any operating expenses.

Write off bad debts – In today’s economy, the reality is that not all customers are able (or willing) to pay their bills. If you encounter this, you might want to consider writing those off as bad debts.

If any of these tasks resemble a fire drill, slows or shuts down regular accounting activity in your department, or takes more than five days to complete, then you have some areas of improvement to get into shape.

Know the Race Rules

Run year-over-year reports – Compare preliminary reports for the current year with reports for the previous year to hunt for income or expense discrepancies that aren’t backed up by documentation or changes in your business that occurred this year.

Record depreciation – If you have fixed assets, you have to account for depreciation. Seek out your accountant to assist you with this task.

Address prepaid expenses – Some businesses choose to prepay for services such as insurance. When a prepayment is executed, it’s recorded as an ‘asset.’ Later, it’s reclassified as an expense. Don’t forget about this essential task.

Close out owner’s draw – Any money withdrawn from the company for personal use must be accounted for in an equity account.

Begin the 1099 process – Subcontractors must receive their 1099 forms by January 31. Start gathering the information now to save extra time and headaches as that deadline approaches.

If you are unable to run accurate year-over-year reports or if you keep master reports in Excel, then it’s time to upgrade your systems so that you can increase your endurance for higher levels of data performance.

Take the Incline

Taking on the task of running the year-end reports can be daunting when you’re doing it alone, so involve your employees in the process, if possible. When more people take ownership, there is greater accountability, and you can reap immediate improvements. Also, be sure to document your processes so team members can feel empowered to use the documentation guides and offer upgrades to your processes and systems.

Working to complete the tasks listed above will position you well to hit your stride and not get caught scrambling over the finish line at year-end, or worse, hitting the wall.

Pacific Crest Group provides professional accounting and human resource services that keep your business focused on your critical objectives and the road ahead. Through exemplary customer service, clearly defined policies and procedures as well as a forward-looking perspective, we provide the outsourced solutions your business needs to grow. Contact us today.